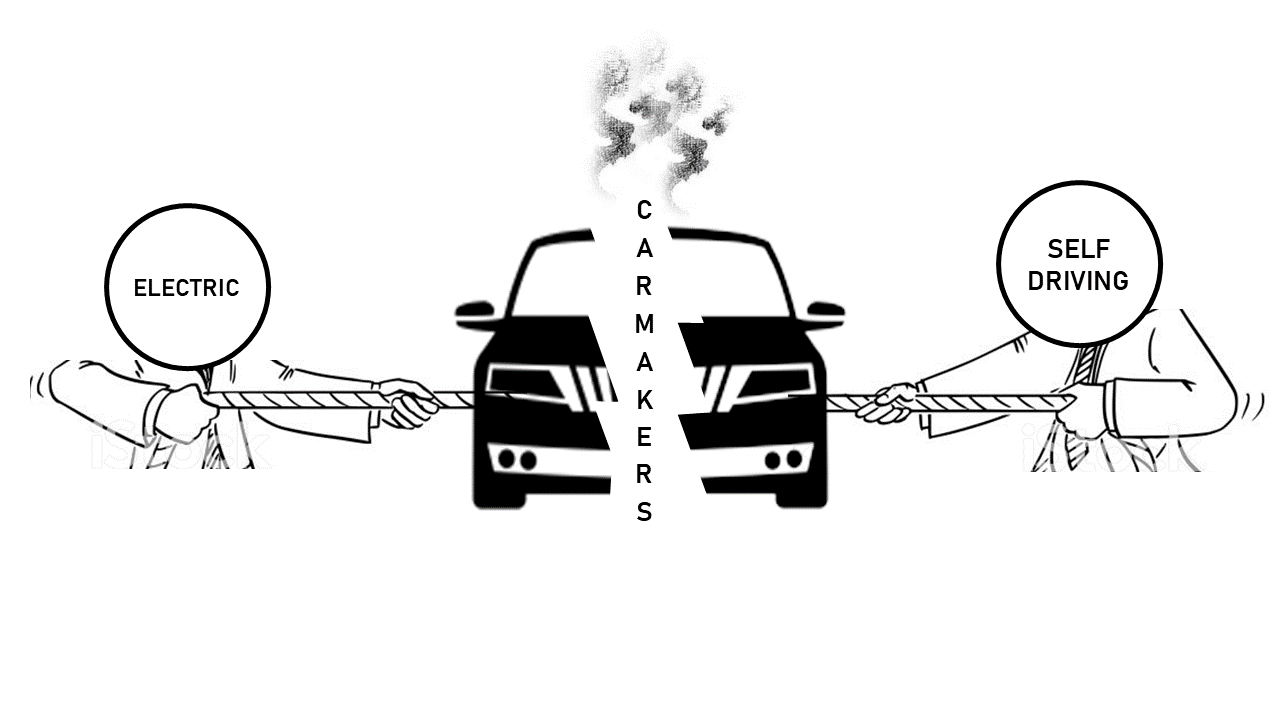

Carmaker’s Trilemma – AV, EV, or Both?

The latest news headlines on the automotive industry portend a very serious developing situation. The following three news items from three major auto manufacturing centres of the world, provide an insightful glimpse into what might soon be coming the carmaker’s way.

New vehicle sales in China plunged by more than 18% to 1.94 million units in January 2020 from an already weak 2.3 million units in the same month of 2019.

Renault posted 2019 net income of €19 million compared to €3.45 billion the year prior and sales fell 3.4% to 3.8 million units.

Detroit is already in the grips of recessionary headwinds triggered by the sudden collapse of demand for traditional sedans, which comprised nearly 50% of unit sales in 2015. That change in buyer preference to SUVs leaves automakers with excess capacity of 3 million units that no one wants to buy.

In this article, I share my perspective on force vectors of change in technology, consumer preferences, and policy-making environment, subjecting the carmakers to an angst they have not known before.

The automotive industry is consequential, representing gross revenues of over $2 trillion, production of over 90 million vehicles and employing nearly 60 million people directly and indirectly. No wonder carmakers get tax-payer funded subsidies and bailouts in tough times – the 2009 financial crisis being a case in point. Given this level of political clout, one would argue that it would be practically impossible for a significant carmaker to go out of business. However, this time around, other than worsening market conditions, there are other very powerful forces at play that will alter the landscape of the automotive industry in a fundamental way. In my view, automated driving technology more than any other factor will determine the disruption or the evolution of the automotive industry over the next three decades.

Volume production has been to date, the predominant consideration for carmakers and the entire industry revolves around this measure. The volume metric that has underpinned the automotive industry for so long is being questioned by carmakers for the very first time. Herbert Diess, CEO of Volkswagen (VW), one of the world’s largest carmakers by production volume selling nearly 11 million units in 2019, is now looking for profitable production - 10,000 Bentleys that deliver higher profit margins to VW are better than a million others that don’t. However, this is easier said than done. The search for profitable production is complicated for carmakers because production base cannot change quickly whereas consumer preference can change rapidly.

Swift consumer uptake of ride-sharing services was the first impactful change that gave the carmakers reason to react. Mass-market success of companies like Uber, unlocking personal car ownership into a service-based taxi model was seen as a threat to future car sales. Suddenly, carmakers had to contend with the possibility that future buyers of cars (think in terms of household demand being the primary driver of growth in production volumes) may disappear very quickly if consumers shift transport consumption from car ownership to services like Uber.

This was soon followed by explosion of interest in autonomous driving. The idea of an autonomous Uber was a double whammy. Not only would the cake disappear, but an altogether new cake would be baked for which the carmakers neither had the recipe nor ingredients at hand. We saw a mad frenzy by carmakers ploughing billions of investment dollars in ride-sharing and autonomous vehicle technologies. The heady days of billion-dollar autonomous vehicle start-ups are still fresh. The carmakers were so petrified by such a future that they never paused to do the sums. Only now, as the robo-taxi dream has evidently become distant and ride-sharing companies continue to amass losses, carmakers seem to be finally putting the equation together. Recent announcements by Daimler and Magna shifting their focus away from urban autonomous mobility are early indicators of this reality sinking in.

Almost all meaningful innovations in the automotive industry have traditionally occurred in the production system. For a very long time, carmakers never considered EV technology to be a mass-market innovation or even a possibility until Tesla showed it to be otherwise. Despite a fraction of the volume of what VW manufactures, Tesla is now sending shivers down the spine of all major carmakers. Recent remarks by Herbert Diess are telling – Tesla is being valued as a tech company and carmakers aren’t.

In my opinion, there are three fundamental competitive advantages Tesla enjoys over every other carmaker.

1) Tesla builds electric cars only, and all production is centred around a single powertrain technology. It owns the battery technology supply chain for its own cars. In contrast, carmakers can’t abandon their installed capacity for internal combustion engines overnight and therefore cannot deliver the same performance-price equation on EVs to consumers as Tesla does.

2) Tesla has built the car as a remotely programmable device from the ground up. No carmaker has, or is likely to have this ability for another 5 years.

3) Tesla has the most advanced in-house capability to deploy driving automation technology in series production cars compared to every other car maker.

The automotive industry will now have to play catch up with Tesla on three fronts while also doing what delivers current production volumes. This is not just a difficult call - this is an incredibly difficult and an incredibly complex call.

Carmakers have evolved a cross-ownership led industry structure around optimizing production capacities and sharing technologies, with frequent joint ventures and partial acquisitions. It is a complex web of interdependencies. If a core node of this network starts to fail, this has the potential to propagate on a network-wide basis. This interdependence has meant that no network participant has the ability to compete independently with Tesla. Any of VW, Nissan or Toyota, is a bellwether of the industry and the sound-bites coming from any of them, in essence, apply to the entire automotive industry.

A shift to EV technology is likely to be a long cycle. Despite the enthusiasm of policy makers shooting for 2035-2040 as sunset timelines for internal combustion engines, the reality may be far more complicated. The electric utility upgrade for delivering last mile capacity, shift to renewables within the utilities themselves under pressure from environmental concerns worldwide, the need to widen availability of charge networks around the world, charge time issues, and range anxiety of consumers are complicating factors. In addition, there is the trillion-dollar hurdle of change in automotive production capacity shifting from internal combustion engine to full electric. The restructuring of production capacity within automotive manufacturing will lead to major social dislocations resulting in massive job losses, and gargantuan new investments would be required. Given the economic headwinds, this seems like a far cry. Carmakers know these realities, and an early shift to EV would only be undertaken by carmakers if consumers were to demand EV as a core expectation. The question then becomes whether EVs are the core expectation of consumers today or is it something else?

I see automated driving technology as a force that is rapidly shifting consumer preferences as demonstrated by Tesla’s Autopilot system. Consumers overwhelmingly enjoy the automated driving capability of the Autopilot despite the fact that it may still not be a perfected autonomous driving system. There is no arguing that Tesla is being valued as a ‘tech stock’. A review of buy-side equity research on Tesla stock from Ark Invest or Citi reveals that the bullish case target valuations for Tesla are being derived mainly from its likely path to ‘autonomous’ - ultimately leading to fleet-based sharing economy effects.

It is clear that consumers are rapidly shifting preferences to a car that can drive for them, most of the time if not all the time, on most, if not all routes. Tesla has evidenced this consumer preference shift unarguably. Unless carmakers can catch up on advanced automated driving technology disruption is writ large, and no carmaker no matter how big, will be immune to it. Adding nicer cup holders or very basic ADAS features won’t cut it anymore.

13 trillion passenger vehicle miles are driven around the world on highways, with 250 billion hours of driver time spent behind the wheel every year. These are numbers to think about. Carmakers have only one evolutionary path to escape their angst - deliver advanced automated driving technology to rival or beat Tesla.